Agriculture, and more broadly food systems, play a central role in plans and programs to achieve the Sustainable Development Goals (SDGs) and the Paris Agreement’s objectives of climate mitigation, adaptation, and resilience. Mobilizing adequate financial resources to cover the costs of those plans and programs is essential.

|

"Many of the cost estimates for the SDGs and climate change objectives for developing countries (without China) suggest the need of additional financing of $3 trillion-$4 trillion annually, and up to $680 billion annually for food systems only" |

Yet current levels of financing remain insufficient to achieve both the objectives of the 2030 Agenda and the Paris Agreement, particularly in developing countries, according to the UN Secretary-General’s summary of the July 2023 stock-taking two years after the UN Food Systems Summit (UNFSS), and the Political Declaration of the September 2023 SDG Summit.

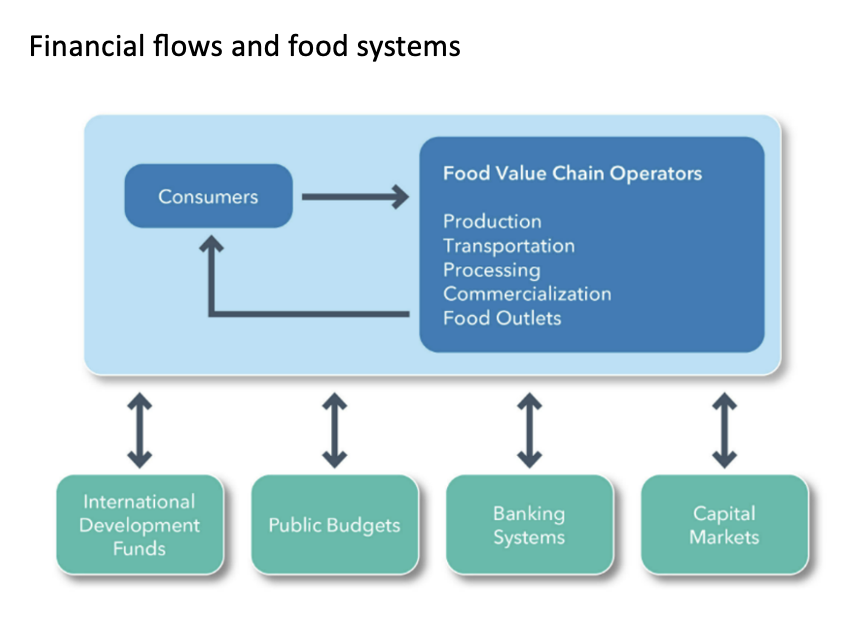

With COP28 coming up—followed by more international gatherings in 2024—participants face an urgent question: How can the world close that gap? A flurry of public and private initiatives and proposals aim to mobilize the additional funding required, though which may move forward is unclear. Here I will briefly comment on some of the most recent initiatives, using a simplified framework of six financial flows developed with IFPRI colleagues (a summary of that work is discussed in Díaz-Bonilla, 2023; see Figure 1 based on Díaz-Bonilla, Swinnen and Vos, 2021).

Figure 1

Source: Díaz-Bonilla, Swinnen and Vos, 2021

Two of those flows of funds (top, in blue) are internal to food systems: Food and food-related expenditures by consumers (first flow), which in turn represent the sales/revenues of all the operators throughout the agrifood value chain (second flow). This blog post focuses on the other four flows (bottom, green) external to food systems: International development funds (multilateral financial institutions, bilateral aid agencies, and philanthropic groups); national government budgets; banking system operations; and capital market finance.

Expand international development funds

Most of the current debates center on how to scale up international development funds (IDFs). While these are the smallest of the flows in terms of overall value, they play a very important catalytic role in stimulating other financial flows. A central focus is on expanding the lending capacity of multilateral development banks (MDBs), optimizing the use of their current capital for greater leverage (by better risk-pricing the preferred creditor status and the guarantee of the callable capital), expanding operations with private capital markets, and better use of guarantees, among other things.1 In addition, there still may be a need for an increase in the capital of the MDBs.

|

Implementing all these measures could increase financing by an estimated $260 billion annually by 2030; this includes about $200 billion through normal lending and the rest in concessional funding. |

Another important discussion is how to make the different MDBs work together more effectively. It is good that MDBs sign agreements to collaborate on certain topics. But more robust coordination mechanisms will most likely be needed, such as those that were established to implement the Marshall Plan for Europe and the Alliance for Progress in Latin America and the Caribbean.

There is a parallel dialogue on how to more effectively use Special Drawing Rights (SDRs) issued by the International Monetary Fund (IMF)—reallocating some percentage from countries that do not need them to instead finance support to vulnerable developing countries.

In June, IMF Managing Director Kristalina Georgieva announced that the original $100 billion reallocation target had been achieved. Now she is asking to increase the reassignment of SDRs for an amount that could add another $100 billion.

However, in addition to the amounts being reallocated, we must also consider the potential leveraging effect of different uses for these funds. Currently, the two IMF trusts receiving the reallocated SDRs are the Poverty Reduction and Growth Trust (PRGT) and the recently created Resilience and Sustainability Trust (RST). Those two options have a limited multiplier effect (1 reallocated SDR generates an additional 1 SDR of financial support). Yet other options have a much larger multiplier effect, such as allocating SDRs to MDBs, or constituting a guarantee fund at the IMF to allow developing countries to issue perpetual bonds to replace shorter-term debt and finance programs to achieve the SDGs and the climate-change objectives. In all these options, a crucial constraint consists of the differences between national legal frameworks that direct the use of SDRs as reserve assets of the central banks.

Meanwhile, other promises of assistance remain, at best, in a state of flux. Developed countries have yet to fully deliver on their commitment, made at COP15 in 2009, to collectively mobilize $100 billion (mostly concessional) per year by 2020 for developing countries to address climate change. At COP27 in 2022, participants agreed to the creation of a Loss and Damage Fund to compensate low- and middle-income countries for climate impacts they largely bear little responsibility for. However, the controversial issue of its funding (including the use of carbon taxes on aviation, shipping and fossil fuels extraction) remains unresolved.

In all these proposals for IDFs, a key point is to ensure that each is distinct from the others, and that they add up to something larger—we should work to avoid a situation in which the different numbers bandied about don’t end up amounting to a modest, relatively fixed pool of funds with labels that keep on shifting.

Optimize public budgets and build cushions

All of the other three external financial flows are larger than IDFs. For example, total outlays from public budgets in developing countries amount to $8 trillion (nominal average 2014-2019).

How can funds be reallocated from public budgets for these major challenges? One important policy debate focuses on repurposing agricultural subsidies in order to reduce climate impacts and free up funds for climate mitigation and other purposes. More generally, all public expenditures should be evaluated with the same general goals: Some—such as social protection nets—must be scaled up and optimized; others—such as generalized fossil fuel subsidies—should be eliminated (see Díaz-Bonilla, 2021 and Díaz-Bonilla and Echeverría, 2022).

The financial group of the UN Food Systems Coordination Hub (which I have been advising) has developed a tool called 3Fs (financial flows to food systems) to help countries estimate their current food systems expenditures. It focuses on five pillars that correspond to the typical structure of developing country ministries. It can be utilized as a starting point for the evaluation of public expenditures and help improve their structure and quality.

Governments also must strengthen revenues through better tax administration and by overhauling sales, income, wealth, and trade taxes. Developing countries should also benefit from the implementation of international initiatives to control corruption, tax evasion, and other practices that erode their tax bases. Hopefully, the October 2021 OECD member agreement that established a global minimum effective corporate tax rate of 15% for large multinational enterprises will also benefit developing countries.

In addition, several initiatives (such as the Common Framework) aim to reduce the burden of debt in developing countries and expand their fiscal space—but these are advancing very slowly, and should also be expanded to middle income countries. Another initiative that would help to strengthen resilience is the inclusion in public loans and bonds of automatic clauses that allow debt suspension or stretching of payments when systemic shocks occur, such as climate disasters and pandemics. Also, debt-for-climate and debt-for-nature swaps can reduce fiscal pressures, freeing resources to address SDGs and Paris Agreement objectives.

Shaping financial flows related to banking systems, capital markets, and from other economic agents

The final two financial flows related to food systems—from banking systems and capital markets—should also be scaled up and redirected towards the SDGs and climate change objectives.

In the first category we should distinguish between public development banks (PDBs) and the different types of private banks (micro, community, and cooperative banks to larger commercial banks).

The initiative Finance in Common, launched in France in 2020, brings together a large number of public development banks—including those already contributing to IDFs and, importantly, a variety of national and sub-national public banks—with the objective of aligning their operations towards the SDGs and the Paris Agreement.

Several proposals exist to guide private banks, private investors in capital markets, and also private actors in food value chains (one of the two internal flows) towards supporting the SDGs and climate objectives. These include increasing the costs of investments that serve to undermine desired sustainability outcomes (e.g., requirements to disclose negative environmental externalities); reducing the costs of investments aligned with meeting sustainability objectives (e.g., lowering the cost of capital and better risk management); reducing uncertainty (through improved macroeconomic and sectoral policies); and lowering transaction costs (for example, pre-investment facilities that help develop projects and investable vehicles).

Consumption expenditures (the other internal financial flow—in blue in Figure 1) can also be influenced by improved tax subsidies and regulatory frameworks (including labeling requirements and stricter advertising norms) to steer food consumption towards sustainable, safe, and healthy diets.

Is that enough?

All of these proposals and initiatives are valuable. However, we must consider two further constraints.

First, the food system flow-of-funds framework (Figure 1) has built-in “budget constraints”: Given a certain level of overall economic activity and the budget constraints implied in double-entry accounting, scaling up one financial flow towards some objective implies scaling down others, with general equilibrium implications that need to be considered.

Second, and just as relevant: Most of these cost estimates and financial proposals are global or for developing countries as a whole, while actually achieving the SDGs and Paris Agreement objectives requires individual developing countries to enact their own programs. Those must include detailed objectives, policy instruments, institutional arrangements, and costs and financing, bringing together the national pathways outlined by the UN Food Systems Summit with the Nationally Determined Contributions (NDCs) and National Adaptation Plans (NAPs) of the climate negotiations.

Unfortunately, many countries may not yet be following through on these necessary steps. The important UNFSS stock-taking summary shows that among surveyed developed and developing countries, only 33% acknowledged “Costing of the pathway/implementation plan” and just 29% mentioned having an “Investment plan/strategy for the implementation of the pathway” in their plans for the transformation of food systems. The report notes that only a few countries (and cites Georgia and Uruguay) referenced their NDCs.

My impression is that authorities in developing countries are overwhelmed by the different workstreams and the multiple demands on their time placed by so many international initiatives, on top of having to attend their immediate problems (particularly food security, variously defined). Efforts to generate and direct hundreds of billions of dollars in funding won’t do much good without detailed national plans with operational programs. Thus, we must find ways to overcome this particular obstacle.

During COP28 and the 2024 UN Forum on Financing for Development (which will report to the Summit of the Future a few months later and serve as a basis for the Fourth International Conference on Financing for Development in 2025), participants should focus on how to provide developing countries with specific financial and methodological support in order to set up the internal institutional machinery needed to coordinate their national work (which extends far beyond the broad outlines of climate negotiations). At the same time, stronger national coordinating mechanisms should also be central components of a more robust international arrangement that history tells us is needed to guide multilateral organizations and international initiatives. Putting such measures in place can help ensure that climate funding, whenever it arrives, will be well-spent.

------------------------------------------------

1. In the 2000s, as Chairman of the Budget and Financial Policies Committee of the Board of Executive Directors of the Inter-American Development Bank, I remember advocating those changes, which faced strong resistance from the developed countries at the Board and the staff in charge of risk management. It is good that now are being considered.

Eugenio Díaz-Bonilla is a Visiting Senior Research Fellow with IFPRI's Director General’s Office, Special Advisor to the Director General, IICA, and an Advisor to the Financial Group of the UN Food Systems Coordination Hub. Opinions are the author's. Cited IFPRI research is peer-reviewed.

Eugenio Díaz-Bonilla is a Visiting Senior Research Fellow with IFPRI's Director General’s Office, Special Advisor to the Director General, IICA, and an Advisor to the Financial Group of the UN Food Systems Coordination Hub. Opinions are the author's. Cited IFPRI research is peer-reviewed.

Note: This article appeared first at IFPRI Blog : Issue Post.

This post is part of a series examining key issues involving climate and food systems—here, climate finance—as the 2023 UN Climate Change Conference (COP28) in Dubai approaches (November 30-December 12).

The opinions expressed in this article are the responsibility of the author and do not necessarily reflect the opinion of IICA.

|

If you have questions or suggestions for improving the BlogIICA, please write to the editors: Joaquín Arias and Eugenia Salazar. |

Add new comment